Mortgage applications eased for the second consecutive week. According to the Mortgage Bankers Association, mortgage application activity, which includes both refinancing and home purchase demand, was 1.7% lower on a seasonally adjusted basis in the week ending Feb. 15. In the week ending February 8, the market index fell by 6.4%. The most recent decline in weekly seasonally adjusted mortgage applications reflected both a 1.7% drop in refinancing applications and a 1.7% decrease in mortgage applications for purchase.

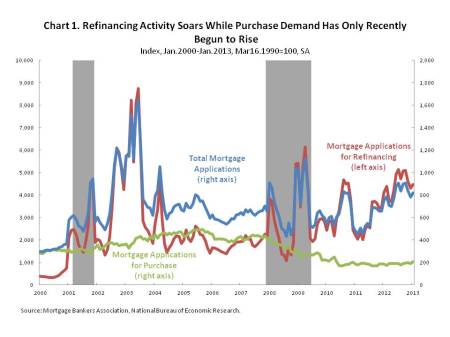

Applications for a refinancing account for the majority of growth in mortgage applications. The impact of refinancing applications partly reflects its share of total mortgage applications. Refinancing applications currently account for 72.5% of all applications. In addition, applications for mortgage refinancing have grown faster than applications for mortgage purchase. As Chart 1 illustrates, mortgage applications for refinancing have risen steadily since early 2011. Meanwhile, mortgage applications for purchase have remained relatively flat through 2011 and most of 2012, rising noticeably only in the last few months. Between March 2011 and October 2012, total mortgage applications grew by 78.2%. During this same period, mortgage applications for refinancing more than doubled, rising by 115.4% while mortgage applications for purchase grew by only 1.1%. Since October 2012, total mortgage applications have declined somewhat as the drop in applications for refinancing more than offset the increase in the mortgage applications for purchase. Over the past four months, total mortgage applications have decreased by 9.6% as mortgage applications for purchase rose by 6.7%, but mortgage applications for refinancing declined by 12.6%.

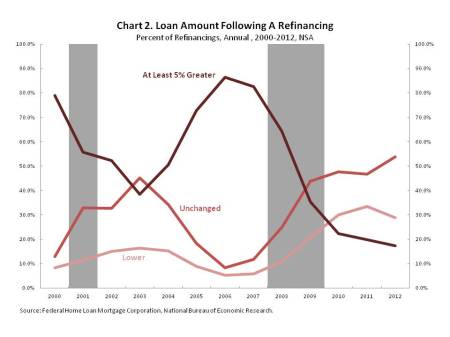

The Federal Home Loan Mortgage Corporation compiles statistics on loans it purchases that refinance loans already held in its portfolio. These statistics are based on a sample of properties for which it has funded two or more successive loans. In 2012, 53.8% of these refinancings resulted in a new loan amount that was unchanged from the previous loan, an increase of 7.2 percentage points from 2011 and 8.6 percentage points from its 2003 peak. Meanwhile, the share of refinancings that led to either a higher loan amount or a lower loan amount both declined between 2011 and 2012, by 2.5 and 4.7 percentage points respectively. Conversely, between 2003 and 2006, the vast majority of these refinancings resulted in a higher loan balance for the homeowner. In 2003, 38.5% of refinancings resulted in a new loan balance that was at least 5.0% greater than the pre-refinanced loan balance, while 16.3% of refinancings led to a lower loan balance and 45.2% of refinancings had no effect on the loan balance. By 2006, the share of refinancings resulting in at least a 5.0% higher loan balance grew to 86.3% while the share of refinancing that resulted in a lower loan balance stood at 5.3% and the share refinancing that left the loan balance unchanged was 8.4%. However, between 2006 and 2011, growth in both the share of refinancings resulting in a lower loan balance and in the proportion of refinancings that leave the loan amount virtually unchanged have offset the decline in the percentage of refinancings that led to a higher loan amount.

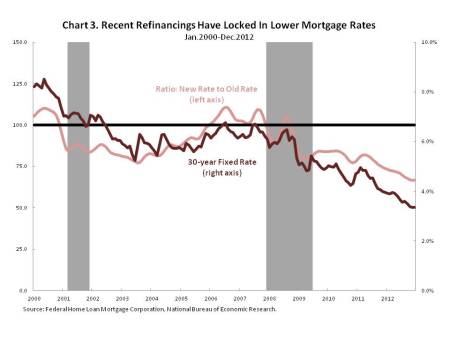

In addition to its data on loan amounts, the Federal Home Loan Mortgage Corporation also maintains statistics on the ratio of the new to old mortgage rate and reports the median ratio. In this ratio, the numerator is the mortgage interest rate on the newly refinanced loan amount and the denominator is the rate on the old mortgage. The data exclude adjustable rate mortgages. A ratio equal to 100.0 indicates that the average refinancing did not change the mortgage interest rate while a ratio below 100.0 means that a refinancing resulted in a lower mortgage rate on average. A ratio greater than 100.0 indicates that refinancing led to a higher average interest rate.

As mortgage rates rose between January 2003 and December 2005, the difference between the mortgage interest rate on the old mortgage and the interest rate secured after refinancing began to shrink. By January 2006, refinancing resulted in a higher interest rate, on average. As Chart 3 illustrates, between January 2003 and December 2005, the 30-year fixed rate mortgage rose by 0.4 percentage points to 6.3%. Meanwhile, the ratio of the new rate to the old rate rose by 18.5 points to 99.7. In January 2006, the ratio reached 100.7. The ratio of the new rate to the old rate remained above 100.0 until November 2007 and it eclipsed 100.0 again during the third quarter of 2008.

More recently, refinancing has allowed some existing homeowners to lock-in a lower interest rate and lower their monthly mortgage payment. As Chart 3 shows, the recent decline in the 30-year fixed mortgage rate coincides with a decrease in the median ratio of the new mortgage interest rate and the old mortgage rate. Between April 2011 and December 2012, the 30-year fixed mortgage rate fell by 1.5 percentage points to 3.4%. At the same time the ratio of the new rate to the old rate declined by 15.4 points to 66.5. In other words, the new mortgage rate obtained from a refinancing was, on average, 66.5%, of the old mortgage rate. According to research by NAHB, a new interest rate that was both 3.4% and was also 66.5% of the old mortgage interest rate, 5.0%, would result in an estimated mortgage payment savings of roughly $182 per month or $2,184 per year on a $225,000 mortgage loan. Over the span of 30 years, an existing homeowner would save an estimated $65,520 under these conditions.

[…] these market updates, NAHB recently took a deeper dive on a few analytical topics. New research examines the role that the wave of recent refinancing activity has had on household mor…. In fact, refinancings now account for 72.5% of all mortgage applications. Since 2010, the share […]

We stumbled over here by a different website and thought I might check things out.

I like what I see so now i’m following you. Look forward to finding out about your web page repeatedly.

Car shopping is stressful. Now that there are hundreds of makes and models to

choose from, not to mention promotions and payment options, it’s easy to become frustrated and stressed out. The information here will help make buying a car as easy and stress-free as possible.