Yesterday, NAHB hosted its bi-annual Construction Forecast Webinar (CFW). The CFW featured three industry experts. NAHB Chief Economist David Crowe was joined by Maury Harris, Chief US Economist at UBS, and NAHB Senior Economist Robert Denk to present views on the outlook for the US economy and the housing market more specifically.

Here are the major points from the presentation:

David Crowe, Chief Economist at NAHB, highlighted the importance of an improved economy for a continuation of the housing market recovery. Recent growth in GDP and payroll employment as well as a decline in the unemployment rate were cited as evidence of current economic strength, and these trends are expected to continue. The demand side of the housing market equation has shown signs of improvement. Consumers have expressed greater confidence and have followed up this sentiment by purchasing durable goods such as home furnishings and automobiles. Despite slightly higher interest rates, housing remains affordable. Nevertheless, home builders still face significant headwinds. These include lot supply and labor availability. Credit access has improved, but likely hasn’t returned to normal. However, these supply-side constraints should recede over time. Taken together, improving economic fundamentals combined with a more optimistic consumer and an increasing need for new homes should support a continuing recovery in the housing market.

Maury Harris, Chief US Economist at UBS, expressed the view that a housing market recovery and broader economic recovery will depend on the availability of credit. He noted that banks currently have about $2 trillion in lending capacity courtesy of monetary policy, but that lending standards remain tight. As the risk associated with lending shrinks, banks will increase their willingness to lend, which should support job growth. He presented evidence that the easing process may have already begun; financial market measures of risk are declining and lending standards are beginning to ease. Ultimately, as the employment situation improves, especially for “millennials”, household formations should expand and pent-up demand should be released, resulting in greater home sales and higher home prices. As a result of eased lending standards and an expanded capacity to lend, both the housing market and broader economy are expected to strengthen.

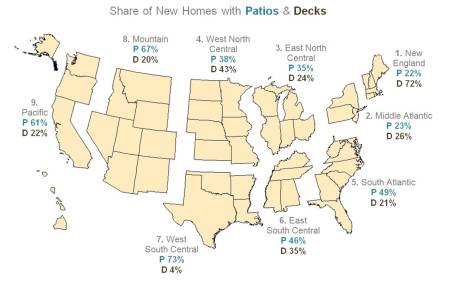

Robert Denk, Senior Economist at NAHB, agreed with the general consensus that the housing market recovery should strengthen over the next few years, but noted that the recovery will vary across the country. The regional variation partly reflects the depth of each state’s housing market contraction. States where the contraction was greater will take longer to recover, while states that experienced a relatively shallow decline will recover more quickly. Second, the extent of the housing bubble, symbolized by a house price-to-income ratio, varied amongst states. States such as Florida and Nevada experienced a ratio that was double their longer-term average while states such as Wyoming and Kansas saw their ratio peak at less than 20% above their long-term average. Regional variation will also be affected by foreclosures, both the level of foreclosures and the speed of the foreclosure process. States with a larger foreclosure inventory will take longer to rebalance supply and demand and return to normal levels of production. At the same time, eliminating the foreclosure inventory is more difficult in states that have a judicial process in place to govern foreclosures. Finally, regional variation will result from the strength of each state’s underlying economy. Housing production will be better supported in states with a more robust rate of economic growth.

Posted by Michael Neal

Posted by Michael Neal