National Association of Realtors (NAR), Existing home sales, as reported by the National Association of Realtors (NAR), surged 14.7% in December, including an increase in the first-time buyer share to 32%, the highest share since August. December sales snapped back from a November decline partially attributable to delays in closings from the rollout of the Know Before You Owe mortgage disclosure rule by the Consumer Financial Protection Bureau (CFPB). The new rule was designed to help consumers understand their loan options and avoid closing cost surprises. Total existing home sales in December increased to a seasonally adjusted rate of 5.46 million units combined for single-family homes, townhomes, condominiums and co-ops, up from 4.76 million units in November. December existing sales were up 7.7% from the same period a year ago.

Existing sales increased in all regions, ranging from 8.7% in the Northeast to 23.2% in the West. Year-over-year, all regions increased, ranging from 4.6% in the South to 11.9% in the Northeast.

Total housing inventory decreased by 12.3% in December, and is 3.8% lower than its level a year ago. At the current sales rate, the December unsold inventory represents a 3.9-month supply, down from a 5.1-month supply in November. Some 32% of homes sold in December were on the market for less than a month.

The distressed sales share decreased to 8% in December from 9% in November. Distressed sales are defined as foreclosures and short sales sold at deep discounts. The December all-cash sales share decreased to 24% from 27% in November and 26% in December 2014. Individual investors purchased a 15% share in December, down from 16% in November and 17% a year ago.

The December median sales price of $224,100 was 7.6% above last December, and represents the 46th consecutive month of year-over-year increase. The median condominium/co-op price of $209,900 in December was up 4.9% from last December.

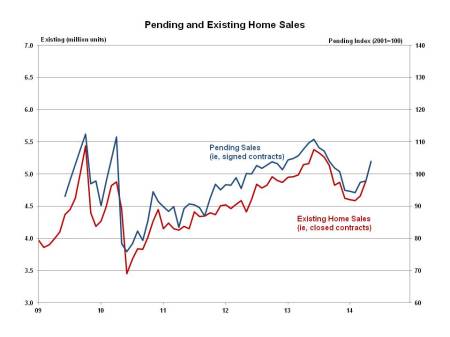

Although the Pending Home Sales Index fell slightly in November, the sharp volatility in November and December sales was a function of implementing a new regulation. Builder sentiment remains strong, and the tight inventory of existing homes bodes well for new single-family sales in 2016.

Posted by NAHB

Posted by NAHB