In 2005, Congress established a number of energy-efficiency tax incentives related to housing. These policies include the tax code section 45L credit for the construction of energy-efficient homes, the 25C credit for retrofitting existing homes, and the 25D credit for the installation of power production property in new and existing homes.

Using earlier IRS data for tax year 2009, we previously examined who benefitted from the 25C and 25D credits, as well as how homeowners used the credits. Last year, we examined the 2010 data for these credits.

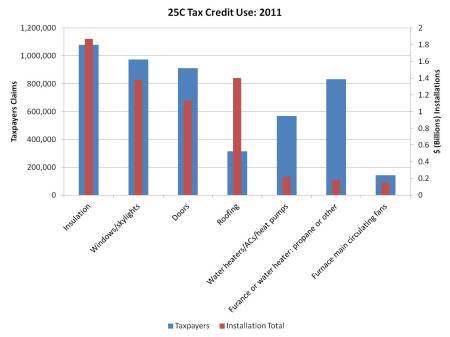

With the publication of the tax year 2011 IRS data for 25C and 25D, significant reductions in use are clearly seen due to the rule changes that occurred at the end of 2010.

For example, from 2009 through the end of 2010, the 25C credit for existing homes was available as a 30% credit and $1,500 limit. After the extension of the “tax extenders” legislation at the end of 2010, those rules were pared back and retained when the credit was extended again as part of the Fiscal Cliff deal. Among those rule changes, the credit was reduced to a 10% rate and a $500 lifetime cap was imposed. It is worth noting that this version of the credit, along with many other tax extenders, expired at the end of 2013.

The 2011 IRS data show significant declines in 25C use as a result of the 2010 changes. The largest impact came from energy-efficient windows, for which the total dollar volume of installed qualified property fell from about $7.8 billion to approximately $1.4 billion. Qualified furnace installations declined by more than $5 billion, reaching a 2011 total of about $180 million.

Tax credit qualified insulation installations fell by more than $1.5 billion but was the largest category in 2011 at a total of $1.87 billion. Roofing retrofits were second with a tally of $1.4 billion.

In total, more than $6 billion of qualified improvements were made in 2011 in connection with the 25C credit. These expenditures resulted in more than $750 million in tax credits for just shy of 3.5 million homeowners.

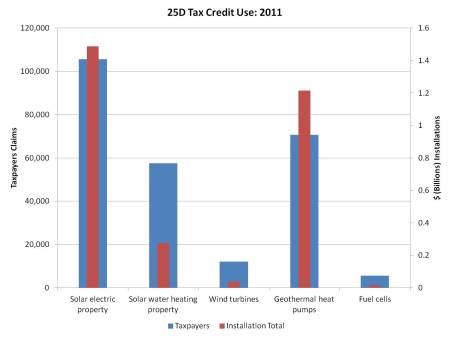

In contrast, tax credit use under section 25D of the code expanded in 2011 from 2010 levels. The 25D credit is for installation of qualified power production property in both new and existing homes. The credit is equal to 30% of expenditures, including certain labor costs and is claimed by the homeowner. Unlike the 25C credit, the 25D program remains in law and is scheduled to sunset at the end of 2016.

The most popular 25D investment in 2011 was the installation of residential solar panels. 25D qualified solar electric property investments totaled almost $1.5 billion in 2011 for more than 100,000 taxpayers. It is worth noting that these solar installations reflect credits claimed for electrical system integrated panels that provide power for the home, as well as panels used to power stand-alone property like attic fans.

The second largest category was geothermal heat pumps, with $1.2 billion of installations claimed by more than 70,000 homeowners. The geothermal category experienced the largest growth in 2011 in terms of tax credit claims, up almost $300 million in total installations over 2010 totals.

In total, for 2011 there were $3.03 billion of qualified power production investments yielding about $921 million in 25D credits.

Given the rising popularity of items like solar panels, builders are well advised to examine the 25D program for prospective homeowners. The 25D credit can be awarded in new construction by providing the eventual homeowner an itemized breakout of material and labor costs associated with qualified property installation, so that the homeowner can claim the credit on their income tax return. An IRS Q&A on 25D and 25C can be found here.

[…] local governments. And new IRS data shows that the volume of remodeling activity generated by the 25C tax credit experienced a significant drop after 2010 policy […]