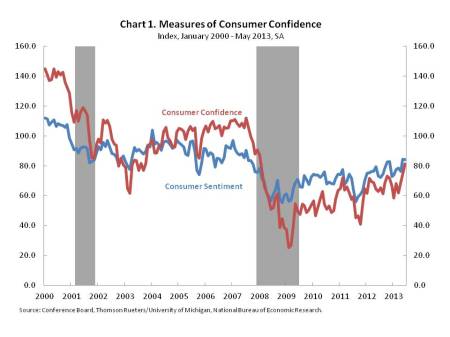

Measures of consumer confidence were mixed in June. According to Thomson Reuters and the University of Michigan, the Consumer Sentiment Index was basically unchanged from May, falling by 0.5% on a monthly seasonally adjusted basis to 84.1. The final reading of consumer sentiment was revised up from the preliminary reading of 82.7 that was released earlier in the month. Meanwhile, the Conference Board reported that its Consumer Confidence Index rose by 9.6% on a monthly seasonally adjusted basis in April to 81.4. However, the month-over-month increase in the Conference Board’s measure of consumer confidence partly reflected a downward revision in the original May reading from 76.2 to 74.3.

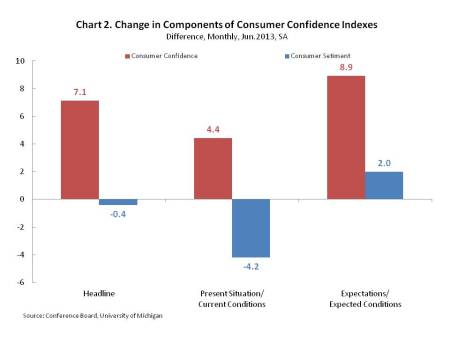

Both measures of consumer confidence are composed of a current conditions component and an expectations component. A previous post showed that month-over-month changes between the Consumer Confidence Index and the Consumer Sentiment Index may diverge as a result of differences between the present situation component of the Consumer Confidence Index and the current conditions component of the Consumer Sentiment Index. As Chart 2 illustrates, both the present situation and the expectations components of the Conference Board’s Consumer Confidence index increased over the month, while only the expectations component of the University of Michigan’s Consumer Sentiment Index rose.

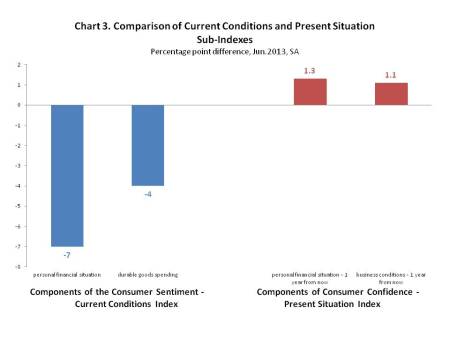

The opposite movement by the Consumer Confidence – Present Situation Index and the Consumer Sentiment – Current Conditions Index reflects the wedge between consumers’ view of the economy and their view of their personal finances. As chart 3 illustrates, the proportion of respondents expecting an improvement in employment and business conditions grew. However, the change consumers’ assessment of their personal financial situation and the change in consumers’ attitudes toward durable goods spending both fell.

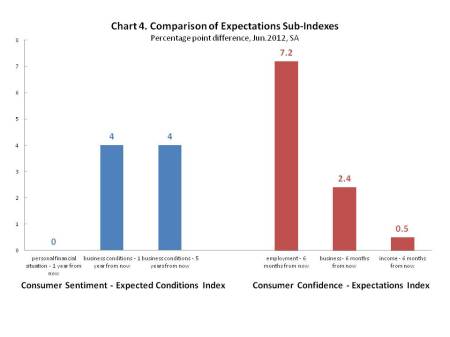

The month-over-month increase in the Expectations component of both the Consumer Confidence and the Consumer Sentiment Indexes masks weakness in consumers’ views of their future personal finances. Chart 4 shows that while consumers were sanguine about their expectations of economic growth, as measured by business conditions in the Consumer Sentiment Index – Expectated Conditions and business and employment conditions in the Consumer Confidence Index – Expectations, respondent’s were less optimistic about the future of their personal finances. According to Chart 4, while a growing percentage of respondents to the University of Michigan’s survey expected business conditions to improve there was no improvement in the share of respondents that expected their personal finances to improve in a year. Similarly, the share of respondents to the Conference Board’s survey that expect business conditions and employment conditions to improve grew by 7.2 and 2.4 percentage points on net. In contrast, the percentage of respondents that expected their personal income to rise in the next 6 months rose by only 0.5 percentage points on net.

The University of Michigan’s Consumer Sentiment Index is composed of 3 questions on personal finances and 2 questions on general economic conditions. As a result, pessimism in respondent’s assessment of their personal finances more than offset their optimism over general economic conditions. Meanwhile, the Conference Board’s Consumer Confidence Index is composed of 1 question on personal finances and 4 questions on general economic conditions. The weakness displayed in consumers’ assessment of their personal income 6 months from now only partially offset consumers’ growing optimism of business and employment conditions, both now and in the future. These results indicate that the movement in the opposite direction that took place this month by the two measures of consumer confidence largely reflects differences in survey structure as opposed to mixed signals given by consumers. While consumers are optimistic about general economic conditions, they are less confident about an improvement in their personal finances.

May I just say what a comfort to uncover somebody who actually knows

what they are talking about over the internet.

You certainly know how to bring an issue to light and make it important.

A lot more people must look at this and understand this side of the story.

It’s surprising you are not more popular given that you surely have the gift.

Hi mates, its great post about tutoringand completely explained, keep it up all the time.

This is very interesting, You’re a very skilled blogger. I’ve

joined your feed and look forward to seeking more

of your great post. Also, I have shared your website in my social networks!

[…] consumer demand. On the one hand the increase in consumers’ use of credit cards may reflect growing confidence in the economic recovery. On the other hand, consumers may be increasing their use of revolving credit in order to offset […]

[…] consumer demand. On the one hand the increase in consumers’ use of credit cards may reflect growing confidence in the economic recovery. On the other hand, consumers may be increasing their use of revolving credit in order to offset […]

[…] consumer demand. On the one hand the increase in consumers’ use of credit cards may reflect growing confidence in the economic recovery. On the other hand, consumers may be increasing their use of revolving credit in order to offset […]

[…] Consumer confidence surveys indicate optimism about current conditions, although with some concerns …. Perhaps most important for housing, the Federal Reserve continues to pursue accommodative monetary policy that helps keep interest rates low. […]

[…] Consumer confidence surveys indicate optimism about current conditions, although with some concerns …. Perhaps most important for housing, the Federal Reserve continues to pursue accommodative monetary policy that helps keep interest rates low. […]